SBIR Phase II Selections

On April 22, 2024, NASA selected 107 technology ideas from 95 small businesses to receive Phase II funding through the SBIR program. The full list of selected small businesses and technologies is available on our Phase II opportunity page.

Read the press release

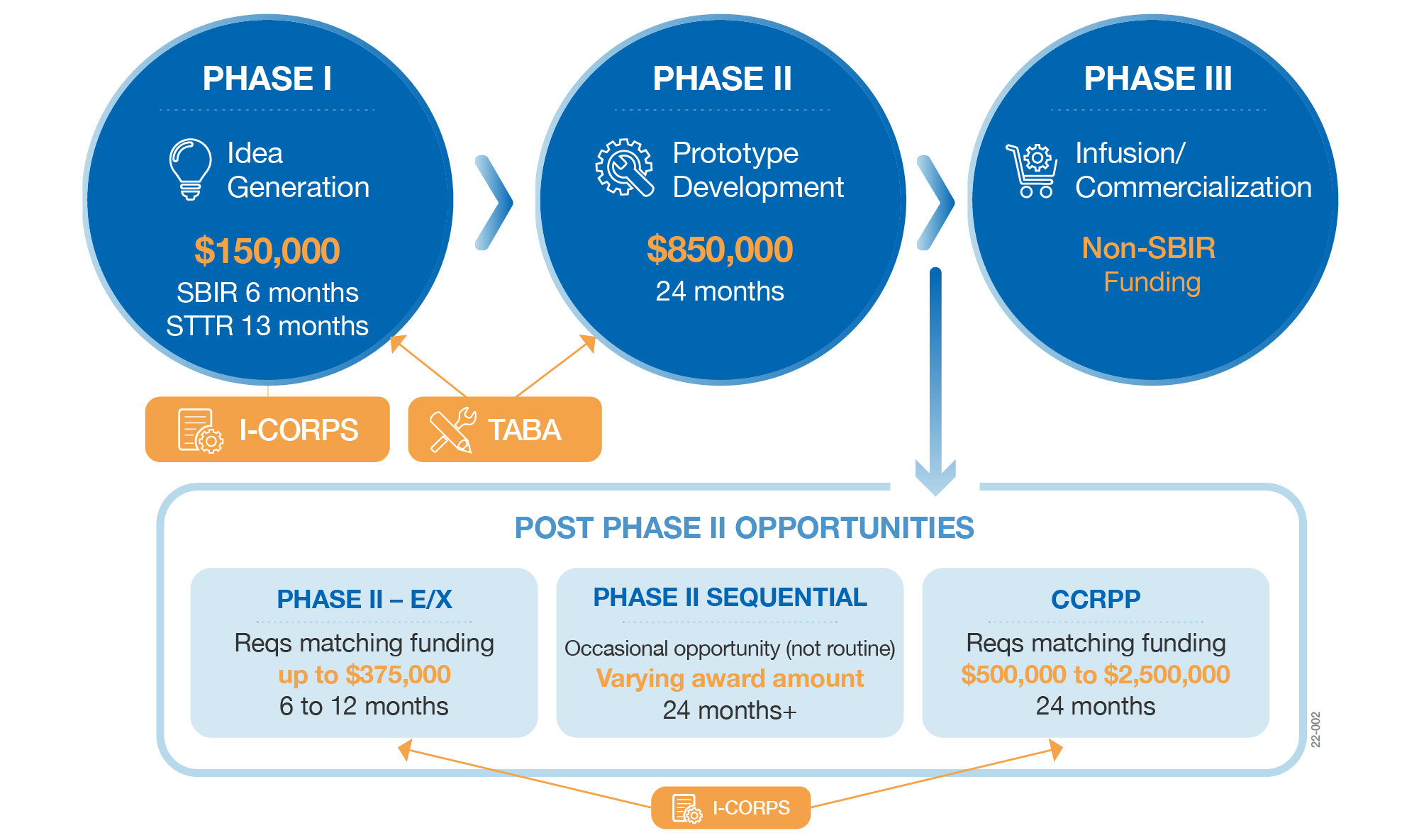

NASA SBIR/STTR PHASES

Learn more by visiting the applicable page on the Opportunities menu dropdown

NASA SBIR/STTR Program Schedule

Find recent & future opportunities across the program

Last Updated: 04/22/24 | All dates are subject to change

| Opportunity | Open Date | Close Date | Selection Announcement |

|---|---|---|---|

| Phase II | 2023 SBIR Phase II Solicitation | 12/18/23 | 2/2/24 | 4/22/24 |

| I-Corps | Post Phase II and SBIR Ignite Submissions | 1/30/24 | 2/13/24 | Spring 2024 |

| Post Phase II | 2024 CCRPP Submissions | 12/13/23 | 2/20/24 | Spring/Summer 2024 |

| Phase I | 2024 NASA SBIR/STTR Phase I Solicitations | 1/9/24 | 3/11/24 | June 2024 |

| MPLAN | Pre-Phase I Opportunity for MSIs | 2/12/24 | 4/15/24 | 5/17/24 |

| Post Phase II | Phase II-E Submissions | — | 4/30/24 | Spring 2024 |

| SBIR Ignite | 2023 NASA SBIR Ignite Phase II Solicitation | — | 6/21/24 | Fall 2024 |

| SBIR Ignite | 2024 NASA SBIR Ignite Phase I Solicitation | June 2024 | July 2024 | Fall 2024 |

| Phase II | 2023 NASA STTR Phase II Solicitation | 7/22/24 | 9/2/24 | Fall 2024 |

SBIR/STTR News

Read recent press releases and articles about the program's awards, as well as stories of the success and impact our awardees are having on NASA and the country.

Learn More about SBIR/STTR News

We are one piece of the SBIR/STTR pie

America’s Seed Fund is coordinated by the U.S. Small Business Administration (SBA), which provides resources and support to the NASA SBIR/STTR program and 10 other participating Federal agencies. The SBA tracks SBIR/STTR awards across the government, provides helpful program information, hosts frequent virtual and in-person events, and offers connections to others in the innovation ecosystem who may be able to help you if you need support outside of the NASA SBIR/STTR program.

Learn More on SBIR.gov

Office of Inspector General (OIG) | Report crime, fraud, waste, & mismanagement in NASA programs to the OIG